Canada now has its first official drug kingpin and its a company in Ontario.

The US Department of the Treasury’s Office of Foreign Assets Control yesterday designated a Canadian company as part of a significant foreign money laundering organization and drug trafficking organization.

The Kingpin Act is used for the most serious of designations and includes the most powerful TCOs in the world, the ‘Ndrangheta, as well as the most powerful Mexican cartel, the CJNG, as well as the Sinaloa Cartel and Los Zetas. Both El Mencho and El Chapo are designated drug kingpins.

The Canadian company which joins their ranks, Smile Technologies Canada Ltd., is registered in Ontario. This is believed to be the first time the US has designated a Canadian company as part of a network of a significant money laundering organization and a significant drug trafficking organization pursuant to the Foreign Narcotics Kingpin Designation Act.

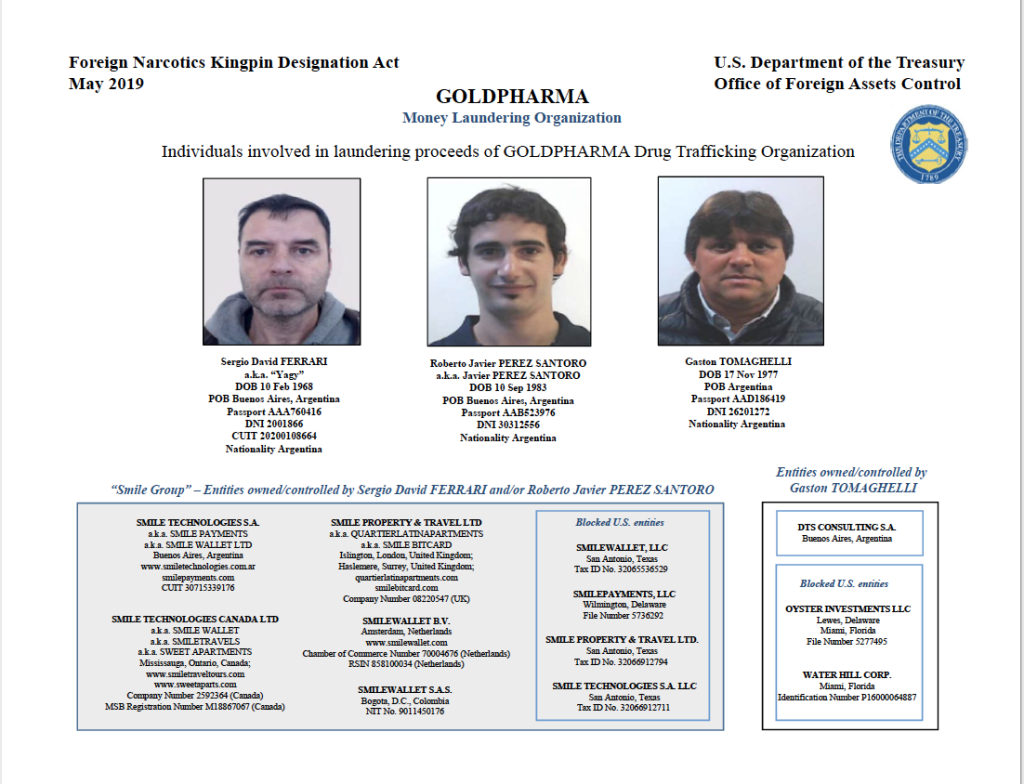

The Canadian company is part of a designation of a network of individuals and companies identified by OFAC as the Goldpharma Drug Trafficking Organization and Money Laundering Organization. The network, originating in Argentina, is alleged to have sold narcotics and opioids such as oxycodone and hydrocodone online to users in the US and Canada through websites, and to have helped fuel the opioid crisis in Canada and in the US.

According to OFAC, Smile Technologies Canada Ltd. funneled the proceeds of crime from illegal narcotics trafficking from Canada back to Argentina.

Smile Technologies Ltd. was registered with Canada’s FIU, FINTRAC, as a money services business. The US Treasury has said that the network, including the Canadian entity, demonstrates the sophisticated tactics money launderers use.

It has three offices in Mississauga and three websites operating from Ontario. Its not clear why it was registered as a money services business with FINTRAC and whether it actually operated as a money services business in Canada. It also appears to have operated a payments FinTech of some type and to have been in the crypto space, issuing Bitcoin cards which are reloadable anonymous pre-paid access cards loaded with a certain amount of Bitcoin.

Eight individuals were designated as part of the Goldpharma MLO and DTO, as well as eight other companies. The two individuals designated for money laundering and tied to Ontario-based Smile Technologies Canada Ltd. are Sergio David Ferrari and Roberto Javier Perez Santoro. Five of their partners in the Goldpharma network were indicted in the US in 2018 for narcotics trafficking.

In making its announcement, OFAC noted for one of the first times, that the penalties (for banks, accountants, trustees and such) to not freeze the assets of the sanctioned persons and entities carry civil penalties of up to US$1.4 million per violation, criminal penalties of up to US$10 million and terms of incarceration of up to 30 years.

Pursuant to sanctions law, all property and interests in property of the designated persons in the US or in the possession or control of US persons must be frozen and reported to OFAC. Designations by OFAC under the Kingpin Act are intended to deny significant international narcotics traffickers access to the financial system.

A significant amount of work by US law enforcement agents would have gone into what we call unpeeling the layers of corporate beneficial ownership in many countries to uncover the network’s players and pursuant to the OFAC notice, the information in respect of the Canadian entity’s controllers is not confirmed. The reason for this is that in Canada, beneficial ownership law is complex. Among other things, information in respect of beneficial ownership of private companies is obtainable only if the articles of the company permit the disclosure of such information.

In the past, another Canadian company based in Vancouver, PacNet, was listed by OFAC as a “significant transnational criminal organization” under different legislation, namely Executive Order 13581 which deals with unusual and extraordinary threats to national security, foreign policy or the economy of the US under the authority of the International Emergency Economic Powers Act and the National Emergencies Act.

And before that, another Canadian company, the Lebanese Canadian Bank was listed by OFAC as a primary money laundering concern under the Patriot Act because it facilitated the laundering of money from drug trafficking and trade-based money laundering. The Bank had an office in Montreal and maintained extensive correspondent accounts with banks worldwide.