Complaint filed by the SEC

The Securities and Exchange Commission (“SEC“) filed a complaint in the Southern District of New York this week against RenovaCare, Inc. (the “Company“) and Harmel Rayat (“Rayat“) alleging that material misrepresentations were made in the disclosure material filed by the Company, and that the Company used a secret paid promoter to pump its stock and lied about it.

RenovaCare is an issuer in British Columbia but is listed in the US on the OTC Markets. Rayat is a Canadian who resides in Vancouver, and is one of the original shareholders of the Company, its director and its majority shareholder. There are two previous SEC enforcement actions involving Rayat and others, one in 2000, (here) and the other in 2003 (here); one involved §17(b) violations, which is part of what is alleged in the SEC’s latest complaint.

The SEC is not specifically alleging a pump and dump occurred with RenovaCare per se. Rather, the SEC is alleging that a pump occurred in conjunction with other securities violations but that a brokerage firm stepped into prevent a dump involving one or more of the key actors.

Since the filing of the SEC complaint, the stock price reacted on the OTC Markets.

How securities law works

Skip this part if you know that caveat emptor does not apply in modern securities law, and the capital markets.

By way of background, the Securities Act and the Securities Exchange Act were enacted following the 1929 stock market crash and the Great Depression that followed. The securities acts safe-guard the capital markets and investors by requiring a system of mandatory public disclosures in place of caveat emptor.

The disclosure-based regulation that, as a fundamental principle replaced caveat emptor, is based on trust – it commences from the proposition that in exchange for the privilege of being able to list a stock to the public, and take money from investors who become shareholders, all the actors in the system will be honest and provide the requisite fulsome disclosure. It presumes no information asymmetry from issuers or their advisors. It also assumes that so long as investors have fair access to accurate fulsome material information, they can intelligently assess the risks of a stock and make an informed decision to buy or sell. Disclosure, therefore, is required episodically whenever securities are offered to the public, periodically thereafter, and whenever material events occur.

The private sector actors who are entrusted in respect of the capital markets are those who earn fees and other compensation from capital markets activities and control the content and distribution of disclosure and include lawyers who draft all of the securities disclosure material; auditors who pass on the financial condition of issuers for capital markets participants; an issuer’s directors and officers; significant shareholders; brokers; listing exchanges; underwriters; and securities trust agencies (the “Capital Markets Trustees“).

From time to time, Capital Markets Trustees can and do breach the public trust, in a number of ways including by participating in the drafting of documents containing untrue information, negligently or deliberately. Investors who rely upon such information are lured into making investments without informed consent and with asymmetric information which may be untruthful. All of the Capital Markets Trustees enter the capital markets understanding that they assume responsibilities for their part of a larger puzzle to protect the integrity of the capital markets through, inter alia, adequate, truthful and timely disclosures.

With respect to promoters, it is lawful to use stock promoters and to pay them but it is unlawful to have secret paid promoters for the reasons articulated above.

Medical claims about a skin gun

RenovaCare’s three founders, according to its Sedar filings, appear to have been Kundan Rayat, Jasbinder Chohon and Harmel Rayat.

For decades it was and remains, a development stage company with no revenues. A few years ago, it began to represent that it was developing a medical gun called a skin gun, for treating skin burns.

In mid-2017, the SEC says that the Company prepared and disseminated false information. For example, in its Form 8-K, news releases and paid promotional content, the SEC says that the Company stated that it had filed with the FDA, a 510(k), and that the FDA could soon approve its skin gun, which was untrue. As at that date, the Company had not filed a 510(k) with the FDA.

A secret paid promoter

The SEC says that the Company used a secret paid promoter called StreetAuthority, apparently owned by a longtime friend of Rayat in Austin, Texas, whom the SEC did not name.

The latter published a so-called independent report in which it described a case study involving the Company’s skin gun where a burn victim with what looks like severe burns on his or her arm, was promoted as having been cured in three days using the skin gun.

The promoter published before and after pictures in the report of the burn victim’s alleged cure by the skin gun in three days. The after picture of the burn victim show his or her burn was healed and the skin returned to normal after those three days. According to the NHS, a mild burn heals in 14 days.

The SEC says that the victim’s skin remained discoloured for over a year. Moreover, the SEC says that the photos in the before and after series were, for lack of a better word, disingenuous in that the before photo was not the arm of the burn victim and the after photo was actually taken five years after the victim sustained a serious burn, not three days after.

Alleged false statements

The SEC alleges that part of the disclosure record of the Company during the relevant period, contained materially false statements or was misleading in the way it was drafted and presented in the disclosure documentation, and that the Company engaged in acts designed to defraud investors.

With respect to Rayat, the SEC alleges that he aided and abetted the commission of the unlawful securities law conduct.

Among other things, the SEC alleges that Rayat devised a deceptive payment scheme to hide that StreetAuthority was a paid promoter. StreetAuthority was required to disclose its payments from the Company but failed to do so.

The SEC says that StreetAuthority touted the Company highly, claiming that the burn gun was a revolutionary wound-healing device, encouraging investors to buy the Company’s stock, promising investors they could hold it for 10, 20x, even 40x gains.

The SEC says that the Company executives were questioned by the OTC Markets about paid promotional activities and lied, denying having used a paid promoter.

A reporter here reported that in a recent annual financial statement, in one fiscal year, the Company disclosed that it spent $309,503 on R&D, whereas its executives were paid $453,488 during the same period.

Over ten years earlier, in 2007, David Bains wrote (here), about Rayat and trying to get his foot in the door of his opulent offices in Vancouver.

It didn’t go so well – they asked him to remove his foot from their opulence.

The touting biz

A number of securities law academics looked at the role of promoters (also called touters) across Germany in cases of pump and dumps that manipulated the market.

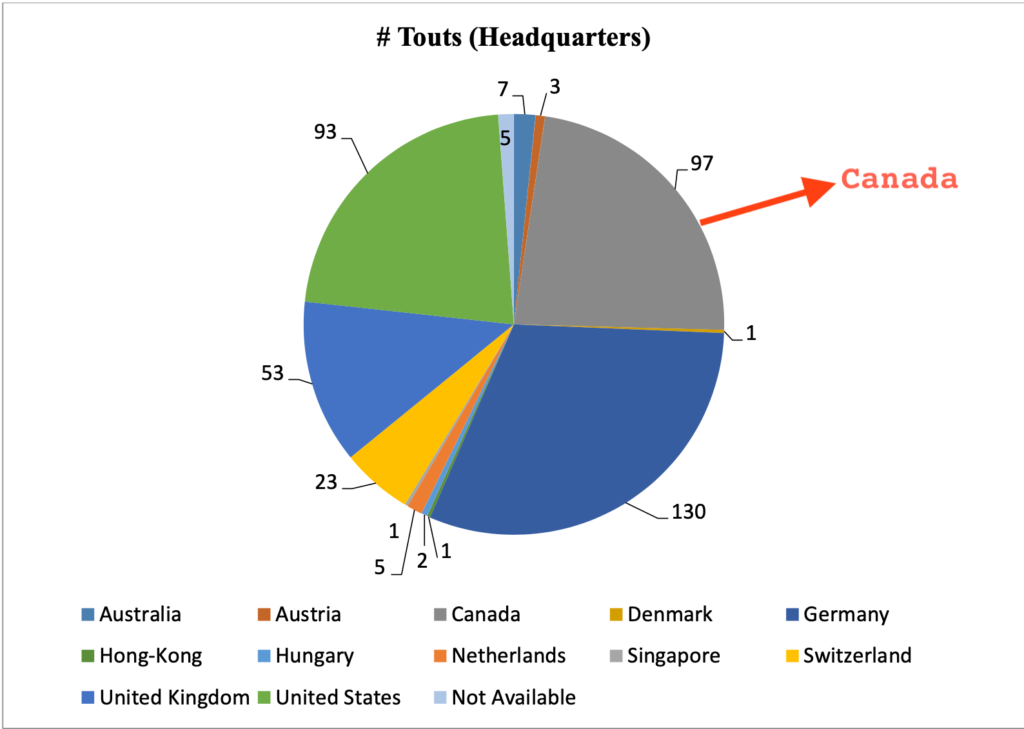

Working with two agencies, the researchers were able to obtain data sets of issuers, Capital Markets Trustees and victims of pump and dump schemes over a set period of time in Germany. The findings with respect to Canadian promoters (touters) in the study are interesting – the data showed that although Canada has 1/10th the population of the US, Canada not only, per capita, breeds more promoters, it breeds more promoters on a pure numerical basis that were active in the relevant time period of the study in the capital markets in Germany.

Another academic study conducted for a mathematics thesis looked at the economics of promotions and promoters. The study found that promoters are raking in US$122,600 per issuer they tout, and earn between US$1,000,000 to US$10,000,000 per year promoting issuers – one earned US$8,000,000 in its first year of business.