China’s influential newspaper Caixin, recently investigated the renewed use of high-frequency trading (HFT) in China’s futures market, operated by foreign companies that, it reports, are incorporated under fictitious corporate purposes.

According to Caixin, some HFT firms are ostensibly registered to engage in the trading of physical goods in China, when in reality they are engaged in HFT activities in China’s markets, and exiting the proceeds from China to other countries.

In China, unlike western countries, the incorporation process involves, among other things, selecting the type of business activities the company intends to engage in and pursuant to which it is approved for registration and operation.

Deliberately selecting a wrong set of business activities to do business in China during the incorporation phase is done to keep a company’s real activities off the regulatory radar.

There is no parallel in the west except that is it similar to the practice in the Bitcoin space among digital currency exchanges and online gambling companies of mischaracterizing their activities to be erroneously merchant-coded as a low-risk activity by credit card processors and banks.

In 2019, the profits to HFT firms operating in China were estimated to be 5 billion yuan, or US$725 million, and 60% of that exited China to foreign HFT firms.

As Caixin explains, foreign firms have been barred from trading in China’s commodity futures market for a long time. In 2018, the crude oil market was opened to registered foreign firms and in November 2021, commodity futures were opened to foreign firms but only under the Qualified Foreign Institutional Investor program and its yuan-denominated program.

The well-known case of Yishidun International Trading Co. 张家港保税区伊世顿国际贸易有限公司 shows that foreign firms have been engaging in HFT activities in China since at least 2014.

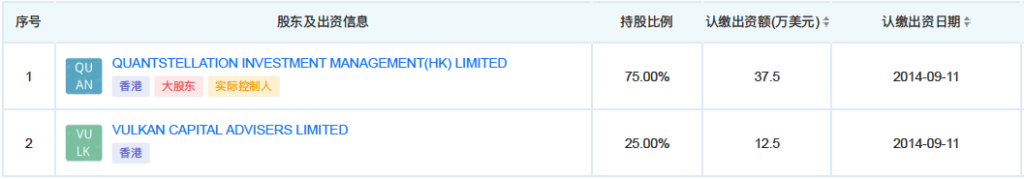

Yishidun is a Chinese registered company owned by two Russian nationals, who controlled the company through two Hong Kong entities, Quantstellation Investment Management (HK) Limited and Vulkan Capital Advisers Limited. It developed HFT software and managed HF trades.

According to Caixin, it traded 3.77 million futures contracts on two major stock indexes in China – the CSI 300 Index and CSI 500 Index – and made profits of 389 million yuan in just over two months during China’s stock market tumble that began on June 12, 2015, and resulted in US$5 trillion being wiped out of the market.

In 2016, Yishidun was prosecuted for market manipulation and the Court determined that it illegally connected its HFT software and technology system to the systems of the China Financial Futures Exchange. It did that through a registered broker in China.

Yishidun was fined 300 million yuan (US$43.9 million) and ordered to disgorge 389 million yuan in proceeds of crime from illegal gains from HFT activities. Three people in China were charged and convicted of criminal offences involving securities market manipulation, and sentenced to terms of incarceration.

The two Russian nationals allegedly departed from Hong Kong to avoid arrest in the case.

Caixin reported that Yishidun invested US$700,000 and did a capital raise in China of 3 million yuan, and made a profit of 2 billion yuan.

The prosecution caused a chill in respect of the deployment by foreign firms of HFT in China’s markets. But apparently not for long. Fast forward to 2022, and Caixin reports that several foreign firms once again have a strong presence in the HFT space in China, including one called Hudson River Trading in the US and another in Russia called AIM Tech. Most, however, are based in the US, according to the Caixin investigation.

One of the issues faced by Yishidun was the problem of converting and exiting its profits out of China under the currency control rules because the proceeds from the trading activity was neither a capital nor a current account qualified category for conversion or exiting by that firm.

Except for the US$50,000 annual amount permitted by SAFE to be converted and exited by Chinese nationals pursuant to the current account rules, any conversion and exiting of currency must be approved and foreign firms engaging in HFT activities do not fit under the set categories determined by SAFE and thus the issue of conversion and exiting still exists at the bank end.

In its periodic reports of money laundering and bank fraud cases using abuses of the current or capital categories to exchange and exit funds, SAFE provides numerous examples of underground banking techniques used and of trade-based money laundering, as mechanisms in which funds are often moved to circumvent the SAFE regulations.

The issue still remains in 2022 from a money laundering and foreign currency conversion and exiting perspective, as it did in 2015 – namely, how is any of the HFT proceeds being converted and exited from China to Russia and the US?

In 2020, China’s Supreme Court cited Yishidun’s conduct as part of seven case studies of securities crime, calling the criminal activities a “new type of manipulation” of the futures market.

It was part of a series of four cases prosecuted in China.

Another was the prosecution of Xu Xiang, who ran a billion dollar hedge fund which was, in essence, the Chinese version of a pump and dump factory, manipulating the stock of many unknown companies. The fund grew 800% in five years.

Until his arrest, Xu was a legend in China because he was a real rags to riches story who turned an investment of 30,000 yuan into 28 billion yuan, with his own sweat and talent. Unfortunately, in the latter years of his fund, the growth was derived from criminal activities and stock market manipulation, and Triads had joined the fund to reap the financial rewards.