The biggest money laundering case in Canadian history, only it isn’t taking place in Canada

The US Securities and Exchange Commission (“SEC”) filed a proposed amended complaint on February 3, 2022, in the US District Court of Massachusetts in case of SEC v. Frederick Sharp, Avtar Dhillon, Zhiying Chen, Courtney Kelln, Michael Veldhuis, Paul Sexton, Jackson Friesen, William Kaitz and Graham Taylor. It’s 91 pages so this is a slow burn, and there are many moving parts. The complaint was amended because Zhiying Chen and Graham Taylor sought further particulars from the SEC. The amended complaint is mere allegations that have not been proven in any court of law.

The case involves allegations that the defendants conducted securities fraud of over US$1 billion in Vancouver, making it the biggest money laundering case in Canadian history. It’s also the largest microcap pump and dump fraud case ever brought to court in the US so it’s a very important case in both countries, with many eyes all over the world on it. The US government says there are thousands of victims. And, I was told, the Canadian Crown, namely the prosecution service, determined that most of the victims are American, which perhaps answers the question of personal jurisdiction of the US government over the defendants. Even if it did not, the correspondent banking system means every defendant conducted financial transactions on and through the US financial system for transactions alleged to have occurred in the amended complaint.

Although the amended complaint does not say so, there are different prongs to this case and this amended complaint is only one such prong. There is a prong involving actions against lawyers; there is a financial services and underground banking prong; and there is a prong against the users of these alleged dark or underground services, whether they be issuers or undisclosed control persons.

The complaint sets out how a very sophisticated multi-layer structure was allegedly put in place with tentacles in high-risk jurisdictions, to allegedly commit securities fraud and launder the money back through layers of corporate vehicles to avoid detection, where facilitators included Vancouver and foreign corporate law firms[1], an underground payment processor with operations in various countries including Canada, and a fake asset manager. The US government says the underground payment processor served no economic purpose, other than to deceive banks and launder money back to control persons [in Vancouver].

Surprisingly, other than Vancouver, which was the starting point and often the ending point of the laundering that was allegedly going on, it all took place in a tiny little village in Finhaut, Switzerland.

Or did it?

Did scammers simply pick an obscure little village and expropriate someone’s address in that village to hoodwink the capital markets into believing a massive international asset management corporation was headquartered in Switzerland?

While there is no money laundering prosecution in this prong of proceedings, the SEC has characterized the multi-party, multi-case scheme as a coordinated money laundering operation and one defendant in one prong has been convicted of money laundering for moving the proceeds of crime attached to this alleged securities fraud scheme.

One thing the allegations make clear, irrespective of who the bad actors may prove to be, is that the three stages of money laundering were consciously deployed in the scheme – for both money and securities – they were placed; they were layered; they were integrated.

The case with these defendants has four legal proceedings – some criminal and some civil. The diagram below (click to enlarge) shows the proceedings, the parties and the allegations of each (and in the case of the SEC, generally and not specifically as against each defendant).

Let’s dig into the new complaint first, then let’s look at tiny little Finhaut, Switzerland.

Criminal Complaint – Dhillon

The criminal complaint against Vancouver’s Avtar Singh Dhillon (“Dhillon”), alleges that Dhillon committed securities fraud, conspiracy and obstructed an official proceeding and an SEC proceeding by lying.

Dhillon allegedly secretly controlled shares of public companies that he was in control of as a director or officer, and sold them after pump and dumps in violation of securities laws. The complaint is based on affidavit evidence of an FBI agent.

The FBI agent deposed that Dhillon worked with lawyers at a law firm in furtherance of the criminal conduct, who didn’t just work to take in the proceeds from illicit stock sales, they set up and managed companies for Dhillon for the express purpose of engaging in securities fraud of little issuers he controlled. Dhillon named one of his companies “Walk on Water.”

The FBI agent deposed that shares of issuers were issued to Dhillon for which no consideration was paid and to cover it up, in respect of one issuer, the Dhillon lawyer and the CEO of the issuer, on the instructions of Dhillon, created and back-dated a share purchase agreement a year later.[2] The Dhillon lawyer then allegedly lied and created other fake documents to move shares secretly held by Dhillon beneficially. When questioned under oath about his shareholdings, the FBI says that Dhillon lied.

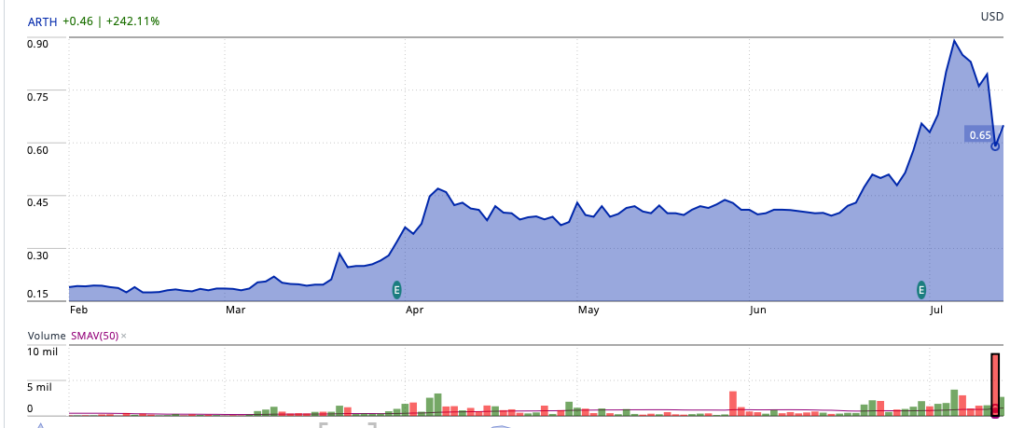

One example provided in an FBI affidavit was the alleged acquisition of shares of Arch through Walk on Water which the FBI says were sold by Dhillon to investors right after they became free-trading, from April to July 2016, allegedly generating proceeds of US$1.3 million to Dhillon. During this time, Dhillon was a director of the issuer, and chairman of its directors.

An FBI affidavit filed in support of the criminal complaint against Dhillon describes how Dhillon’s lawyer allegedly assisted to integrate the proceeds of stock fraud back into the financial system by writing cheques for third parties, including allegedly the spouse of Dhillon, and to a medical treatment centre for his daughter.

The lawyer provided his records to the FBI – he had to – advice in furtherance of a crime (or alleged crime that constitutes more than mere allegations for which there exists tangible evidence) is not legal advice and privilege never attached, and if it did, if there was a pre-criminal phase of advice, then it was waived the moment the intention or the act became imbued with criminality, irrespective of if the lawyer was duped.

Criminal Complaint – Sharp et. al.

In the criminal complaint against Frederick Sharp (“Sharp”), Luis Carrillo (“Carrillo”), Michael Veldhuis (“Veldhuis”) and Courtney Kelln[3] (“Kelln”), the defendants are accused of securities fraud and conspiracy for having provided pump and dump activities as a service to defraud the capital markets. Part of the alleged services involved consolidating control of shares of little issuers by funnelling such shares into several corporate vehicles they allegedly controlled to conceal beneficial ownership.

It is alleged that the corporate vehicles, such as Trius Holdings Limited, Morris Capital Inc., Varese Capital Inc., Santos Torres LLC, and more, used to obfuscate were mostly controlled by Sharp, who charged fees for obfuscation services in Vancouver. Sharp, the FBI agent deposed, also caused the fake asset manager to set up other corporate vehicles for Sharp’s clients. Because the corporate vehicles were designed to be dark, the shareholders and officers/directors on paper were mere nominees.

The FBI says that each corporate vehicle had its own (what we call “disposable”) email address that Sharp Group people created and logged into to send and receive emails, meaning that it was Sharp (or his team) behind the communications pretending it was not Sharp. They used, according to the FBI, “protonmail.com” or “yourmail.bz”. If you follow what’s being alleged here and on this point, it seems that the picture being painted is that Sharp Group people were in Vancouver and were allegedly logging into email accounts of these nominee companies, apparently pretending they were who-knows-who and far away in tiny Finhaut, Switzerland, giving instructions on the acquisition, transfer and disposition of various shares of various little issuers to third parties, and on occasion, to law firms or other parties a mere block away.

To carry out the fraud, the FBI agent says that two lines of communication were used by some defendants– one through email to give the illusion of being legit; the other on encrypted communications where they discussed the alleged criminal conduct, including sharing in the proceeds of alleged illegal stock trades.

Carrillo was a defendant in another SEC proceeding in 2013, involving stock fraud activities in Vancouver, Canada, that involved the proceeds funnelled into a law firm trust account and disbursed. A co-defendant in that proceeding was Benjamin Thompson Kirk, believed to be in the Hope / Kelowna area of British Columbia, who was charged again in September 2021, with securities fraud and is alleged to be a client of the Sharp Group. This is important simply because the entities that are nominees were already on the red flag radar in Vancouver because of earlier enforcement actions.

Carrillo was allegedly in charge of a boiler room in the world’s cocaine capital, Medellín, Colombia, which cold called investors to lure them into buying stock of Evolution Blockchain Group, and its predecessor entity. That issuer, the alleged global Blockchain tech company, was headquartered above a little quilting store on Granville Island, Vancouver. Proceeds, the FBI says, from the boiler room-generated sales of stock to innocent investors, were moved to a number of Sharp nominees, including Santos Torres LLC.

Carrillo allegedly used the proceeds he obtained on luxury and personal items including expensive watches, to pay personal law firm legal bills, for luxury cars, to pay for services rendered by his girlfriend (US$40,000), to pay for a luxury 10-day ski vacation in Switzerland (US$84,000) for he and his family and for Vancouver residents Raymond Dove, the Vancouver convicted fraudster Frank Biller from the Eron Mortgage scandal, and their families, and for high end dental work in Switzerland.

If you follow what is going on here on the latter point, what the FBI affidavit and SEC filings are saying about Vancouver is that people previously kicked out of the capital markets jumped right back into the capital markets and did so using hidden control persons and entities so they would not be discovered, and they not only defrauded the capital markets and investors again, for a second time, but went on fancy exotic vacations and bought a fancy Porsche using the proceeds of fraud paid for by innocent investors. Meanwhile, the first set of investors from previous frauds they were involved in remain uncompensated.

Civil Complaint – Sharp Group

On the civil side, the SEC amended complaint similarly alleges that Sharp provided services in Vancouver to secret control persons of little issuers to help them hide their control so that they could engage in pump and dump activities. One service he provided was as a company service provider.[4]

Sharp rented out the use of corporate vehicles and the offshore bank accounts tied to those corporate vehicles, and also provided payment processing and remittance services as well as acted as a lender. He also allegedly provided what he called: “keeping clients out of jail” services (emphasis in the complaint). According to a subsequent complaint in another of the prongs, he also sold shelf companies in Vancouver for $500,000 each.[5]

The Sharp team included Sharp, Kelln and Zhiying Chen (陈志营) (“Chen”) (together, the “Sharp Group”). Sharp, his brother Thomas, and Chen were directors at one time of a corporate entity in Vancouver called Corporate House. Sharp also had a movie career, which included starring in a short film in 2017, about a man accused of a $100 million stock fraud (embedded from YouTube, below), a very Krystian Bala move.

In order to keep it all secret (and clients out of jail), Sharp allegedly used encrypted phones called X phones, which he allegedly mistakenly believed were not capable of penetration by LE. He also allegedly used an accounting system called “Q”, (after the James Bond movies which feature Q Branch, a WWII quartermaster facility where agents would receive gadgets for underground work).

In the X phone system, Sharp called himself “Bond”.

The SEC says that, on the encrypted X phones and in other encrypted communications, Sharp insisted that the participants use code names, like it was a James Bond movie. Chen’s code name was “Wires” because she was allegedly the money person – allegedly in charge of remittances, wires and the financial transactional work to move the proceeds for the participants.

Dhillon subsequently told the SEC that he also used encrypted communications, but we do not know if he used Sharp’s X phones or the app Threema or something else.

The SEC alleges that both Chen and Kelln fabricated documents and routinely created false invoices[6], loan agreements and subscription agreements for backup in case they were questioned by (financial crime officers at) banks.

The SEC says that Chen was aware that Sharp clients were laundering money through the Sharp Group. The SEC provided an eye-popping organized crime example of Sharp allegedly communicating with Chen on the X phones about a bank draft to Grand Yachts (in Coal Harbour). The SEC says the exchange was as follows:

Sharp: “Hells Angels gives us cash. We give them a draft to buy a boat. Later, boat is seized, polic[e] investigate, find out Charter House [a Sharp Group administered company] paid for it; visit us and ask why. What will u say?”

Chen: “Can we lend money to them [Hells Angels]?”

Chen: “Thomas asks them sign loan agreement for us.”

An FBI agent deposed that on one occasion, Sharp informed Kelln that it is dangerous coming back to Canada (with Sharp records in her possession), but not dangerous in Switzerland, and on another occasion, Veldhuis sent a communication to Kelln after landing in LA that he made it through US customs and was “not in jail. So that’s nice.”

Civil Complaint – Avtar Singh Dhillon

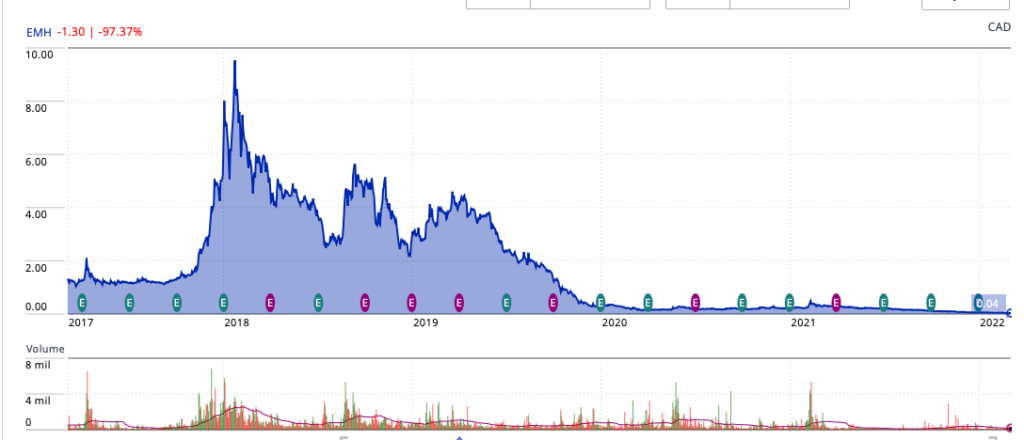

During the period the allegations occurred, Dhillon was at various times a director and often an officer of three little issuers: (a) Legend Mining, which became Stevia First Corp. (“Stevia”), which became Vitality Biopharma Inc. (“Vitality”), which became Malachite Innovations Inc. after the arrest of Dhillon; (b) Arch Therapeutics Inc. (“Arch”); and (c) OncoSec Medical Inc. (“Onco”).

Together with a Vancouver naturopathic therapist named Gaetano Morello, Dhillon worked at an issuer named Contact Gold Corp., and at Inovio Pharmaceuticals Inc., Venturi Ventures Inc., Emerald Health Therapeutics Inc. and Skye Bioscience Inc. According to our review of the securities law disclosure, a small group of the exact same people flowed in and out of these issuers contemporaneously with Dhillon, including one of his nephews, Maheep Dhillon, who was placed in a position of senior management of little issuers with no requisite experience, according to securities law disclosure filings.

The SEC alleges that Dhillon worked with defendants Veldhuis, Paul Sexton (“Sexton”) and Jackson Friesen (“Friesen”) (together, the “ Trio”), and with Graham Taylor (“Taylor”), and they all worked with Sharp and the Sharp Group in furtherance of the alleged scheme.

According to the SEC, in 2011, Taylor introduced Dhillon to an as-yet unnamed Vancouver lawyer in the microcap issuer space who did an RTO of Stevia, and a stock split, resulting in Dhillon holding 31.5 million shares of Stevia. Prior to that, Dhillon acquired 4.5 million shares of Stevia from Tao Chen (陈涛).[7]

From that point forward, the SEC says that Dhillon failed to file insider reports in respect of his share position, and changes of that position, and failed to disclose beneficial shares he held, as well as failed to disclose deals with the Trio to sell shares for him.

Among the services offered by the Sharp Group, the Trio and Taylor were, the SEC alleges, obfuscation services of the identity of shareholders. The obfuscation would be necessary if the allegations are true, to defraud investors (the public) and the capital markets and to provide darkness (lack of visibility) to regulators and exchanges, and a lack of visibility over the movement of funds and its provenance.

The SEC says that several corporate vehicles were used as the tools of obfuscation and to move the illicit proceeds therefrom, including but not limited to, Morris Capital Inc., Trius Holdings Limited, Santos Torres LLC, Caledonia Partners, Peaceful Lion Holdings and if that is proven to be the case, they can only be characterized as criminal enterprises. Again though, the SEC complaint is merely a set of allegations.

Fraud Round One

The SEC alleges that Sharp Group administered entities Morris Capital Inc. and Trius Holdings Limited, among others, were used to receive shares of Stevia. In three months, the Sharp Group administered entities received 19.6 million shares of Stevia and Vitality, in effect becoming fake shareholders because they were mere nominee placeholders. The amount transferred to the Sharp Group was 37% of the issued and outstanding shares of Stevia.

Once the shares were controlled by the Sharp Group, the SEC alleges that the defendants commenced a pump of the stock for a two month period so that its price would jack up artificially. The stock was then dumped when the price was high. That dump, according to the SEC, generated US$24 million in illicit proceeds. Some of the illicit proceeds were transferred from the Sharp Group to a Swiss bank account held by Taylor and Taylor then gave Dhillon a cut of 60%. Dhillon’s cut was wired to Banque Heritage SA, a private bank in Switzerland in the name of Ortivo Enterprises Corp., a Panama company which the SEC says is controlled by Dhillon.

Fraud Round Two

The SEC alleges that Dhillon did a second round of a Stevia / Vitality pump and dump, causing the issuance of 1.3 million shares to another corporate nominee controlled by the Sharp Group which divided those shares into two other nominee shareholders. The Trio then worked to sell those shares and hide the identity of the true shareholders and payments, by running the stock trades back up through Sharp Group nominees.

According to the SEC, Kelln managed some of the paperwork, including using as-yet unnamed lawyers to prepare false closing opinions.[8]

The SEC says that when the proceeds of the illicit stock sales came in, Sexton and Veldhuis allegedly used the X phones to plan distributing the proceeds among them. On March 6, 2014, Veldhuis sent a message to Friesen in respect of his cut of the proceeds:

“u r getting 173k today … buy a boat bitch”

“Rich mother fucker”

In August 2014, Veldhuis asked Chen to give him US$124,000 cash from Stevia. He picked up US$120,000 in cash from Sharp’s office in Vancouver – all in $50s.

Fraud Round Three

The SEC alleges that there was a third round using similar methods in which Dhillon caused to be issued shares in the name of other nominees to hide controlling interests in the issuer and conceal true ownership of the shares. In round three, Sharp directly wired funds to Dhillon’s personal bank account.

The SEC says that the illicit stock was funneled through two of Dhillon’s relatives, whose identities have not yet been revealed, as well as Dhillon’s accountant. Those people then funneled the stock to various other Sharp administered vehicles, including the repeat vehicles Morris Capital Inc. and Trius Holdings Ltd.

The SEC alleges that Sexton met Dhillon in California in October 2014, and that Sexton informed Veldhuis, using the X phones, that Dhillon wanted to be aggressive and get the Stevia price and volume up. Dillon is also alleged to have said all his “buddies” had $0.42 warrants in Stevia and therefore a financing couldn’t be lower than $0.42 (or the “buddies” wouldn’t be in the money).[9]

Additional transfers of Stevia shares were made in Vancouver involving Morris Capital Inc. and Trius Holdings Limited. Round three continued into December 2016, and the SEC alleges that Sexton and Veldhuis, again using X phones, discussed that Dhillon instructed to keep going with a stock promotion and they only had one million “to chew thru”.

The SEC says that, in respect of paying William Kaitz[10] (“Kaitz”) the promoter, certain of the defendants sought to do so deliberately to violate §17(b). The SEC alleges that Kelln, Chen, Sharp and Veldhuis discussed which Sharp Group entity to use as the fake payor.

The SEC says that Dhillon sought to further obfuscate his conduct by directing payments from the illicit stock trades be made to third parties to pay expenses of his family. Sexton allegedly did the same and had a mortgage paid this way for land he owns in California.

The SEC says that Taylor sent invoices to Chen to take care of and she did so using an offshore entity, making entries in the “Q” accounting system.

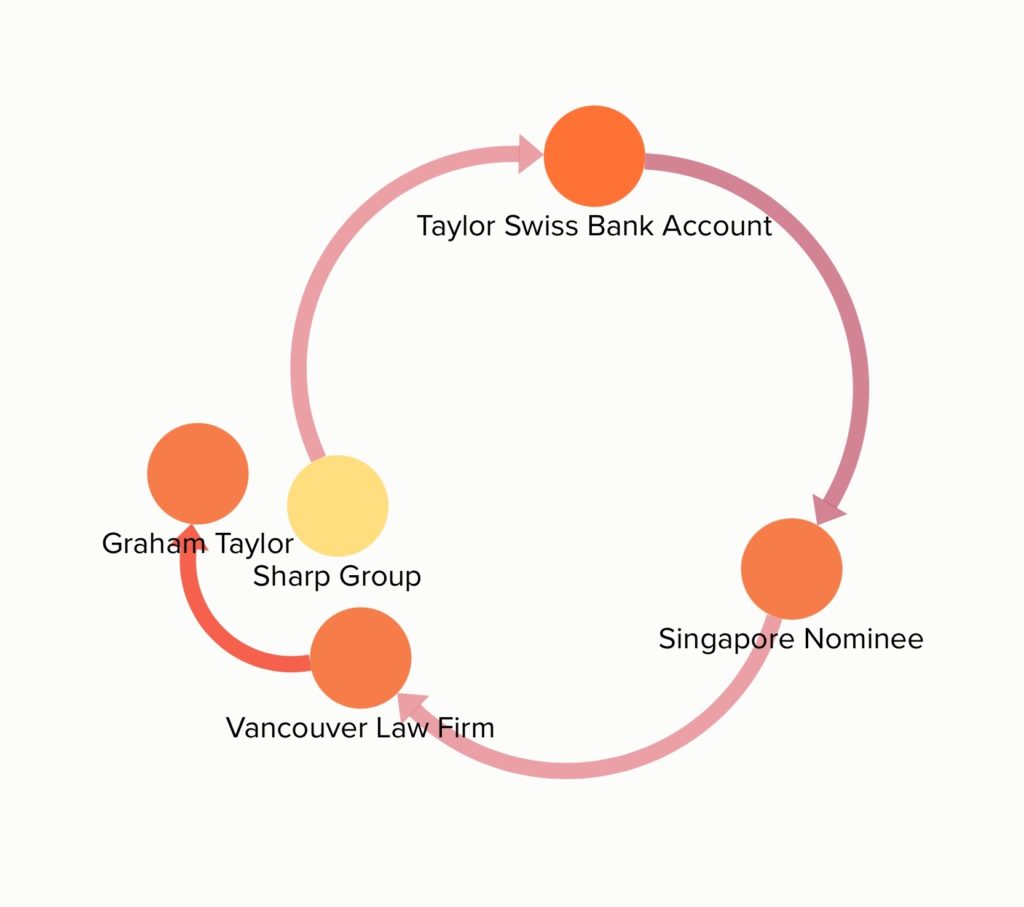

In one instance, Chen allegedly had the offshore entity pay Taylor US$10,000 and when that payment was received, a Taylor nominee in Singapore then wired that amount to a Vancouver corporate law firm acting for Veldhuis in another matter. In other words, the proceeds of the alleged stock fraud went a circuitous route from the Sharp Group in Vancouver –> to Switzerland –> to Singapore –> back to a Vancouver law firm trust account for another matter. In effect, if the allegations are true, the receiving Vancouver corporate law firm acted as Taylor’s laundromat, receiving illicit proceeds. We know from the evidence which law firm this is.

Fraud Round Four

The SEC alleges that Dhillon and his co-conspirators conducted a fourth round of activity secretly selling Stevia stock. In round four, the SEC alleges that the Sharp Group advanced US$4.4 million to buy securities of Vitality and recorded the shares under the same various corporate nominees administered by the Sharp Group. Kelln then paid as-yet unnamed lawyers to write false closing opinions to effect free-trading status of the shares, allowing the shares to be sold to the public. Kelln is then alleged to have structured shareholdings to defeat the 5% disclosure rule writing :

“[the] 5% rule is biting me in the ass.”

The SEC alleges that illicit sales of Stevia and Vitality stock netted US$45,639,343.

Arch Pump and Dump

The SEC alleges that Dhillon engaged in the same conduct in respect of the issuer Arch and employed the services of the Sharp Group, the Trio and Taylor and they conducted similar activities, placing shares in the names of corporate nominees, including the repeat vehicle Morris Capital Inc. The Trio bought, via private placement, shares of Arch and used an as-yet unnamed law firm trust account to take in the subscription funds for the scheme, the SEC says. Dhillon also secretly subscribed for shares via private placement using his Panama entity, Ortivo, to pay US$250,000 for the subscription. Kaitz is alleged to have promoted this stock and did not disclose the true payor.

In respect of the proceeds from the illicit stock sales, the SEC says that Chen refunded Dhillon the US$250,000 he paid for his underground private placement, and wired it to Dhillon’s Swiss bank account, as well as US$200,000 to Dhillon’s accountant, who then wired it to a Dhillon controlled company in the US.

Taylor, the SEC alleges, made payments from illicit stock sales to Dhillon inter alia, by paying $200,000 to a Dhillon creditor and Taylor also had part of his payment from the proceeds of the illicit stock sales ($65,000) wired to the trust account of a different Vancouver law firm, again using a Vancouver law firm trust account as his laundromat, if the allegations are true.

One of the Sharp Group entities used for the circuitous transnational transactions in this round was the repeat vehicle Trius Holdings Limited.

Avtar Dillon Land / Land Documents

The SEC further alleges that Taylor became aware of the US government’s investigation into the conduct alleged in the SEC complaint – from whom, they did not say.

In the Spring of 2021, after learning of the investigation, the SEC says that Taylor then caused to be created legal contracts to fraudulently document an alleged agreement between he and Dhillon to buy an interest in land owned by Dhillon. The SEC did not name the Vancouver law firm that created fraudulent land documents for Taylor in respect of the Dhillon land, and did not disclose whether Dhillon participated in the alleged fraud by signing such documents, and the requisite corporate resolutions in respect thereof.

The SEC further alleges that in addition to being false, the documents were back-dated. The purpose of creating, back-dating and executing the land purchase agreement with Dhillon was, the SEC says, to provide a justification for the payments Taylor made to Dhillon that the SEC says were the proceeds of illicit stock sales. The SEC calculated that the total of the payments to Dhillon as directed by Taylor, was US$7,529,527.

It is probable that the land in question is the land Dhillon owns in Richmond, British Columbia, because of the amount involved and if that is the case, it means that Taylor brought Emerald Health Therapeutics Inc. and Emerald Health Sciences Inc. into the case. But it is only a guess on our part. Both are cannabis companies.

The only property Dhillon appears to own that is worth close to US$7 million in Vancouver, is 32 acres of land in Richmond, and Dhillon’s company Emerald Health Therapeutics Inc., entered into an agreement to pay Dhillon to lease that land for 30 years. According to one of its MD&As, Emerald Health Sciences Inc. also entered into a sub-lease to pay to occupy part of that same Dhillon land.

Normally, therefore, for Dhillon to option, lease, sell or assign, he would have needed the written consent of Emerald Heath Therapeutics Inc, as lessor and Emerald Health Sciences Inc., as sub-lessor.

So, if Taylor’s alleged fraudulent land agreement is over any part of this land, it will conflict with the disclosure record of that issuer, including the financial statements of both entities, and would have required the written consent of those two entities.

Emerald Health Sciences Inc. is or perhaps was now, the control person of Emerald Health Therapeutics Inc. According to an article in a Vancouver business publication, Dhillon co-founded the controlling company with a Vancouver lawyer and with his cousin in Vancouver, Yadvinder Singh Kallu, a US felon (see news article here ).

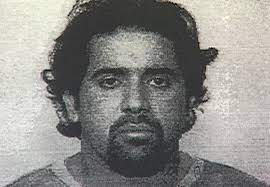

Dhillon’s cousin, Yadvinder Singh Kallu[11] was arrested with another Vancouver man, Diven Karan Nair, by the DEA in 1998, indicted by a US federal jury and then convicted in the US in connection with importing up to 200kgs of highly potent heroin in the US from Pakistan, that originated in Afghanistan, equal to 8 million doses and worth US$84 million at the time. Some of the narcotics were in Pakistan; some had been imported to the US. In that operation, the US government said that they paid undercover DEA agents partially with counterfeit US currency for the drug deal.

“It’s one of the largest heroin cases we’ve ever prosecuted,” said US Attorney’s spokesman Thom Mrozek, referring to the Yadvinder Singh Kallu et. al. case.

The plan of the Canadian drug traffickers, according to a LE affidavit filed in a US proceeding, was to make an exchange with a Colombian drug cartel with whom they were negotiating, to exchange the heroin for 800 kgs of cocaine, which the DEA said was destined for Vancouver.

Yadvinder Singh Kallu’s colleague, Ranjit Singh Cheema, was also arrested and convicted as part of that US heroin trafficking case. His case is well-known because of an unsuccessful legal battle he pursued for many years in Vancouver to avoid extradition and incarceration in the US. Cheema was one of the original Indo-Canadian gangsters from South Vancouver – he was gunned down in 2012 after he was deported from the US at the end of his prison sentence.

Yadvinder Singh Kallu, according to provincial government records available online, was business-connected to Dhillon earlier as well – as early as 2011, as the land agent for Dhillon in respect of the land in Richmond, British Columbia.

The news article referred to above, reports that some of the defendants (Dhillon, Taylor, Sexton and Friesen), as well as some of the alleged Sharp Group vehicles allegedly used for obfuscation and laundering – Morris Capital Inc. and Trius Holdings Limited – are shareholders of Emerald Health Sciences Inc. Santos Torres LLC, another alleged Sharp Group administered entity, appears on that list as receiving shares from Dhillon.

The news article explains how Dhillon made the list of the shareholders of Emerald Health Sciences Inc. public in an affidavit he filed in a proceeding.

According to the list Dhillon decided to disclose publicly, other names include the wife of US felon Diven Karan Nair (he appears to be now possibly a home builder, here), an entity connected to the alleged co-conspirator lawyer in the US criminal proceeding, and US felon Jared Mitchell (here) and (here).[12] There are many others and in fact there is significantly over 50 shareholders, and by far the majority of its shareholders are American.

What’s not in the Complaint?

What’s not in the amended SEC complaint is all the other details of the other prongs of the whole of the multi-pronged case – in particular, the underground payment processing aspects which, as stated earlier, involve at least one person who has pled guilty to financial crimes.

According to affidavits filed in other connected prongs, the underground payment processor rented the identity of two Americans to obtain US bank accounts after they had been de-risked by AML officers at various other US banks, and that the owner of the underground payment processor allegedly lives in Russia.

Evidence from US banks shows that the underground payment processor managed to obtain banking in several countries because it lied to banks about the true nature of the services it was providing. The SEC alleges that the underground payment processor, after moving proceeds from the stock sales all around the world, ultimately parking them in just a few places – one being Vancouver, Canada.

A Tiny Village in Switzerland

One of the more surprising aspects of the case is the role of Finhaut, Switzerland.

Finhaut is a tiny rural mountain village of 300 people, with one main street called Route du Village (literally, the village street in English). The only few businesses are cafés for tourists.

11 route du Village, Finhaut was the office of the fake asset manager, who also seems to have used that address as the fake registered office for some Sharp Group corporate vehicles, including the alleged Sharp administered entities Trius Holdings Limited and Morris Capital Inc.

According to a Suisse real estate agency site, 11 route du Village is a residential apartment beside a café, and apparently, a chauffeur and his wife live there.

No one, it seems, except officers at the AML intelligence units at US banks seem to have wondered how a tiny mountain village with no financial commerce to speak of – not even one bank – could have that much brokerage business, moving hundreds of millions of dollars a year through the financial system.

While the US banks were asking questions of the payment processor, being lied to, and de-risking its accounts, one after the another, the SEC received a tip about a Canadian living in LA, engaged in a pump and dump scheme to defraud investors, using a promoter with a fake corporate address of – you probably guessed it – Route du Village 11, Finhaut, Switzerland.

The Canadian pump and dump executive was trying to raise money to pay a bribe of US$450,000 to get one of his children into Yale. To save his skin, he gave up Rick Singer, the mastermind behind the US college admissions scandal and the rest, as they say, is history.

The college admissions scandal investigation started in Boston, and the Boston office of the SEC, which was already looking at some of the 50 issuers involved in this case, accelerated its investigation.

And here we are.

Avtar Dhillon posted a US$1.5 million bail after his arrest, wears an ankle bracelet, and isn’t talking, having pled the 5th. In December, according to EU company records, he took on an a new role as administrator[13] of the Emerald company VivaCell in Spain, which seems to provide services to other Emerald related companies. He is not allowed to intimidate any witness or obstruct the criminal investigation, or retaliate against any witness or alleged witness, any victim (victims in this case are shareholders / investors) or informants who may have provided evidence against him or others – basically he can do nothing, directly or indirectly, harmful or threatening as against anyone involved in any of his companies or in any way connected to the case, because of the possibility that it violates his bail conditions related to obstruction of justice and lands him in jail with more charges.

And Fred Sharp? No one seems to know where he is; he may simply be chilling in a Vancouver mansion, content in the belief that the services he allegedly sold and warranted as being capable of keeping clients out of jail, will work as intended for his very first client – Fred Sharp.

With respect to the proposed amended complaint filed by the SEC, the two parties who fought for further particulars – Chen and Taylor – changed their minds and now don’t want further particulars, and are opposing the motion of the SEC to use the amended complaint even though the SEC gave them exactly what they wished for.

[1] In the case of Vancouver law firms, no doubt they are unwittingly involved – they are acutely aware from their regulator about such risks to trust accounts, and third party payors.

[2] A red flag in private company share issuances is back-dated entries in the central securities register (“CSR”). The CSR is designed to be chronologically entered and certificates are issued chronologically and numerically and behind those issuances are resolutions and bank records to match dates of payments for shares subscribed for. Out of date CSR entries means back-dating occurred of multiple corporate records.

[3] Her company, Celtic Consultants LLC, appeared in a 2015 SEC complaint involving Panama’s Verdmont Capital SA, along with a number of entities named in this SEC complaint – Morris Capital Inc., Gotama Capital Inc. and Peaceful Lion. In that same case, BetterLife Pharma Inc. executive Sergei Stetsenko, signed a letter for the court in support of Verdmont, as a customer. BetterLife and Dhillon’s Emerald Health Therapeutics cross-over.

[4] In Vancouver, Canada, company service providers perform capital markets legal activities.

[5] A shelf company is a company that is incorporated, has no activity and its minute book sits on a shelf for many years (hence, a “shelf” and not a “shell”).

[6] False invoicing, if that is what occurred here, is a form of trade-based money laundering

[7] It is unknown if Tao Chen is related to Zhiying Chen. Tao Chen stated he owns a company in China named Guangzhou Peace Gift Co. Ltd., and at other times, Peace Gift Co. Ltd., at 2-46 DeZhennan Rd., Suite 403, Guangzhou, Guangdong, China. We searched the corporate databases in China, and could locate neither entity as registered. Tao Chen resided in the US at 634 13th Street, Manhattan Beach, California.

[8] An opinion in this context could be either an opinion that a law firm prepares to close a transaction or to opine in respect of restrictive legends.

[9] We don’t know who the “buddies” are who were warranted out and if they were in the money as a result of the alleged illegal pumping of stock.

[10] Kaitz allegedly has been found inadmissible to enter Canada, according to one defendant.

[11] Yadvinder Singh Kallu is, or was, with an entity named Kannaba Agritech Corp. which, according to corporate records, is located or has an R&R at 409 – 221 West Esplanade in Vancouver.

[12] We downloaded the Dhillon affidavit wherein he disclosed all of the shareholders of Emerald Health Sciences Inc. We first undertook to decloak corporate shareholders and then organized the Dhillon disclosed list by subscription amount, namely who paid the most to invest in Emerald Health Sciences Inc. We removed share transfers and kept only entries of the CSR where the company said that consideration in cash (as opposed to services) was received. For subscriptions in US dollars, we used the exchange rate from the Bank of Canada on the date of the share issuances. In total, Emerald Heath Sciences Inc. received $34,662,811 from subscribers for shares. The apparently rich Roland Gahler, the childhood friend of Dhillon’s partner, the naturopath Gaetano Morello, paid the most as an individual to subscribe for shares – approximately $1,000,000 in cash. Moez Kassam and the Munger Brothers paid the most as corporate subscribers through corporate entities. Cameron Clokie, a dental surgeon in Toronto who was accused of fraud, paid the most using trust vehicles – over $1.5 million in cash for his shares. Another doctor, a botox doctor in Vancouver named Jason Rivers, also subscribed for shares. Offshore, someone in Spain named Maria Rosario Molina Moran paid over $700,000 cash to subscribe for shares; the same Maria Rosario Molina Moran of VivaCell Biotechnology Espana, renamed Emerald Health Biotechnology. The number of home builders who paid to subscribe – a builder of luxury cottages in Muskoka, on the other side of Canada, for example, paid $641,730 in cash for shares. And a builder in Port Moody, and a local electrician subscribed and paid hundreds of thousands of dollars for shares in cash. And even some employees appear to be quite wealthy and subscribed for shares in cash, such as an employee named Riaz Bandali who paid $531,320 in cash, and then paid another large amount later for shares.

[13] A company administrator in the EU has no equivalent in the US or Canada but can be described as a position in a company that has enlarged powers such as a trustee in bankruptcy, only for non-bankrupt companies. Dhillon’s bail conditions say he needed the consent of his supervising agency to take on new employment. This may be new employment because of the enlarged role in a foreign country.