Cease trade order

This week, the British Columbia Securities Commission (the “BCSC“) issued a cease trade order (“CTO“) in respect of the securities of Blok Technologies Inc., (“Blok“) a British Columbia issuer. The CTO was issued for a failure of the issuer to make certain required periodic financial filings on Sedar.

Bridgemark case

Blok is part of the so-called Bridgemark Group scandal, which is a securities law enforcement action by the BCSC against 11 issuers, placees, shareholders and alleged consultants of certain issuers which alleges in essence that funds raised by private placements went to alleged consultants who were paid lump sums of money in advance for consulting services yet allegedly performed no work.

Two issuers admitted consultants did not perform services

Two of the eleven issuers have thus far admitted they paid the so-called consultants from funds raised via private placements for the performance of no work. Many of the same persons, whether as legal or natural persons, cross-over into several of the issuers.

Late filed material contracts

In July 2019, we summarized some of the allegations against Blok (here). As at that date, no material contracts had been filed on Sedar in respect of the consultants or the pre-payment of some consulting fees, and its listing application did not disclose such information. Since then, Blok late filed consulting arrangements on Sedar.

According to those late filings, Blok entered into 23 consulting contracts for services, some of which involve pre-payment before services were rendered and many of which were for the duplication, triplication or more, of the same services. For example, many consultants were paid for the same described services such as web services, corporate services or M&A services. The chart below summarizes some aspects of the contracts in respect of Blok.

Who had consulting agreements?

Table Notes:

(3) The payment to 1113300 BC Ltd. of stock options was at $0.10 per option and may have been what are called in-the-money stock options by up to an amount of $0.18 each option. Based on the closing price of the stock of Blok as at August 7, 2018, an exercise of the options awarded to this consultant was equal to $135,000 if exercised after deducting the payment of the exercise price. An in-the-money stock option occurs when the exercise price is lower than the closing price of the stock so that the person is said to be in the money and no longer has to be incentivized. To grant a significantly below FMV stock option, a director’s consent resolution is required, as is the consent of the listing agency and often the regulator and a lawyer must then provide a securities law opinion in respect thereof for options grants.

(5) The payment to Link Media LLC was in USD. As at the contract date of August 8, 2018, it was equal to $227,902.50.

Almost $5 million paid to consultants

The total amount paid, or payable, to these consultants by Blok seems to have been $4,795,402.50.

On an annualized basis, the four highest paid were Tavistock Capital Corp., Kendl Capital Limited, Hunton Advisory Ltd. and 1113300 BC Ltd.

Fourteen of the consultants executed a precedent consulting agreement (pre-drafted) with terms that are, in substance, verbatim. Each of those fourteen agreed to indemnify Blok and third parties in connection with the consulting agreements for any lawsuits, claims, demands and proceedings, including legal fees for, inter alia, a breach of the consulting agreements or negligence arising in respect thereof, and in addition, to indemnify for omissions in providing contractual services. The BCSC position in the Bridgemark case allegations are that there was altogether a complete omission to provide services by many consultants.

The indemnity provisions surprisingly, do not cap liability at the amount paid under the consulting agreements and therefore, the indemnity amounts that can be sought are limitless and are at least equal to amounts suffered by claimant shareholders, the issuer and the regulator.

Normally, in a consulting agreement involving an issuer, the consultant indemnifies and saves harmless the issuer from and against all claims, actions, losses, expenses, costs or damages of every nature and kind which the issuer may suffer as a result of a breach of a consulting agreement by a consultant or the negligence of the consultant but the contract normally limits that by providing that the liability for any amount or claim, regardless of the form of action, whether in contract or in tort, cannot exceed the greater of the amount of insurance recoverable by the consultant for a claim and the contract amount.

With respect to Blok, each consultant confirmed in writing that it received, or was aware that it could avail itself of receiving, independent legal advice before signing the contracts under which they agreed to indemnify the issuers and third parties.

Schedule Bs created together?

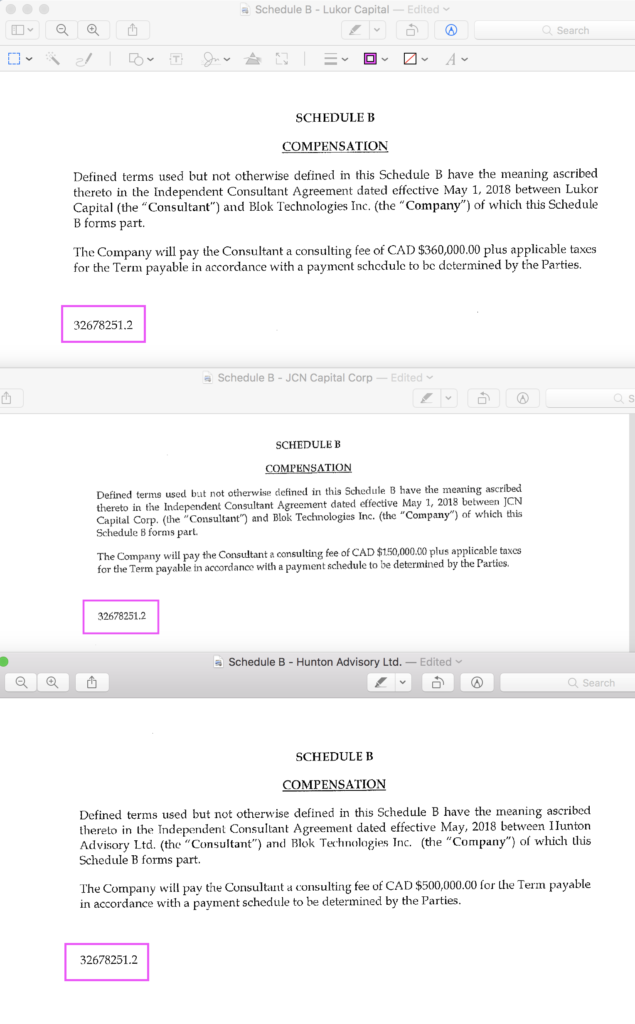

The same fourteen consulting agreements late-filed on Sedar a year ago have an oddity about them. The last page of each agreement, its Schedule B setting out the compensation, presents as a different document – more specifically – presents as if all the Schedule Bs of all the fourteen agreements are one document at the end of each of the fourteen agreements.

They present that way because of what are called law firm footers. Law firms use numerical and sometimes alpha-numerical footers which are different as between firms. In the industry, one can know which law firm created or saved, certain documents by footers.

Footers are document filing and location tools, used so that lawyers can find their own documents in a system. They are auto-generated by document management software that works with word processing software.

The Schedule Bs in the 14 consulting agreements all have the exact same footer and version, namely 32678251.2 (.2 means it was the auto-generated second version of document 32678251).

But only Schedule Bs have a footer – the first 13 pages of every consulting agreement each have no footers at all. And in contrast, page 14 of each consulting agreement has the same footer, suggesting that the compensation schedules were subsequently created as one document separate and apart from the consulting agreements.

Why only one page of the 14 page consulting agreements, the Schedule Bs, of the 14 consulting agreements all have the exact same footer, down to the version, is a mystery. An example of the Schedule Bs of three of the 14 consulting agreements with the same footer is provided below.

No material consulting contracts filed by Cryptobloc yet

Not all the issuers in the so-called Bridgemark scandal have filed their material contracts on Sedar in respect of consultants, as required, which prevents shareholders from having visibility on those arrangements. Cryptobloc, for example, which has undergone two subsequent name changes and is now in the battery business, has not filed its material contracts for its consultants on Sedar. It continues to be listed, though, announcing the raising of more funds from investors and the entering into of new contracts, which are also not filed on Sedar.