The Securities and Exchange Commission (“SEC“) filed more cases in New York over Easter, targeting actors in the Canadian capital markets. The cases are for alleged pump and dump schemes. One of the two latest cases by the SEC charges Courtney Vasseur, a full-patch member of the Hells Angels in Vancouver, with securities fraud and alleges that he was part of a group that controlled eight public companies.

In total, five cases were filed or unsealed charging a group of mostly Canadians with securities fraud brought by the SEC and/or the US government. The defendants in the first set of actions are David Sidoo, Ronald Bauer, Craig Auringer, Adam Kambeitz, Alon Friedlander, Massimiliano Pozzoni, Daniel Mark Ferris, Petar Dmitrov Mihaylov, Chris Lehner (“Lehner“), Julius Csurgo (“Csurgo“), Anthony Korculanic, Dominic Calabrigo (“Calabrigo“), Hasan Sario (“Sario“) and Courtney Vasseur (“Vasseur“).

All five cases are tied to the US$1 billion securities fraud case in Vancouver, SEC v. Frederick Sharp, Avtar Dhillon et. al., which is a series of actions brought by the SEC and the US government. That case alleges that for at least a decade, Vancouver’s Frederick Sharp (“Sharp”) and his associates (the “Sharp Group”) ran a factory of fraud in Vancouver offering securities fraud services, with a tight circle of gate-keepers, facilitators and “corrupt intermediaries”, who together, allegedly defrauded the capital markets and investors of US$1 billion. The money and the securities of many little public companies was laundered and integrated through the Vancouver financial system.

First Case

The first newest case by the SEC charged defendants Dean Shah (“Shah“), Csurgo, Henry Clarke and a corporate entity owned by Csurgo in Toronto, Canada, called Antevorta Capital Partners Ltd. (“Antevorta“). Henry Clarke is tied to Shah in the corporate sense in Malta.

In this case, the SEC alleges that Shah and Clarke were clients of the Sharp Group, and used his services to acquire and conceal control of several public companies to run pump and dumps to defraud investors. Part of the manner in which this was accomplished was using multiple private companies to act as nominee shareholders.

According to the SEC, Sharp sold shelf companies to clients as part of the alleged obfuscation services. In order to communicate secretly, Sharp established an encrypted communication service with devices called X phones, that he used with clients to run the operation and, according to the FBI, assist clients commit fraud without law enforcement visibility. The SEC alleges that Shah and Clarke used the X phone service.

Because the beneficial owners of the stocks involved were concealed behind private companies, the SEC alleges that the defendants were able to pump stocks and dump them on innocent investors at inflated prices. Investors were unaware that stocks they were buying were allegedly derived from fraud and from a secret control group.

The SEC says that one of the pump and dump schemes conducted by the defendants was of Zenosense Inc. (“Zenosense”), and the fraud was carried out in several phases.

The SEC says that Shah and Clarke acquired Zerosense from Sharp, and came to control most of its issued and outstanding shares. When they became the controller of the issuer, and therefore its affiliate, they hid that fact from the market, and failed to make the requisite disclosure filings.

The SEC says that when new shares were being issued, Clarke asked Sharp if the certificates should be mailed to shareholders.

Sharp is alleged to have replied: “Nooo. Never.”

The SEC says that Sharp told Clarke that the share certificates should be sent to a lawyer who would forward them to Sharp. Clarke replied that he was working with a “straight” lawyer, which he stated was concerning. Sharp told Clarke to find a lawyer who would be willing to take the certificates from the transfer agent and send them to Sharp.

According to the SEC, Sharp informed Clarke that the purpose of layering securities[1] was to insulate Sharp in the event of an investigation by the SEC because, according to Sharp, the SEC would not bother the lawyer.

The SEC alleges that a lawyer in Canada working for one or more of the defendants deposited money wired from a bogus financial entity into their law firm trust account. That lawyer then wired the money to another law firm. The SEC says that in some instances, no legal services were rendered in connection with the movement of such money in and out of law firm trust accounts.

Once Shah and Clark had secret control of Zerosense, they allegedly incorporated a shell in Belize through Sharp to act as the hidden payor for promotions of the stock, then pumped the stock and sold it when the price became artificially high, unjustly becoming enriched in an amount equal to US$2.3 million.

A few years later, they allegedly undertook a second pump and dump of Zerosense. This time, Shah and Clarke allegedly partnered with Csurgo in Toronto and his company, Antevorta, to gain control of 90% of Zenosense’s issued and outstanding shares.

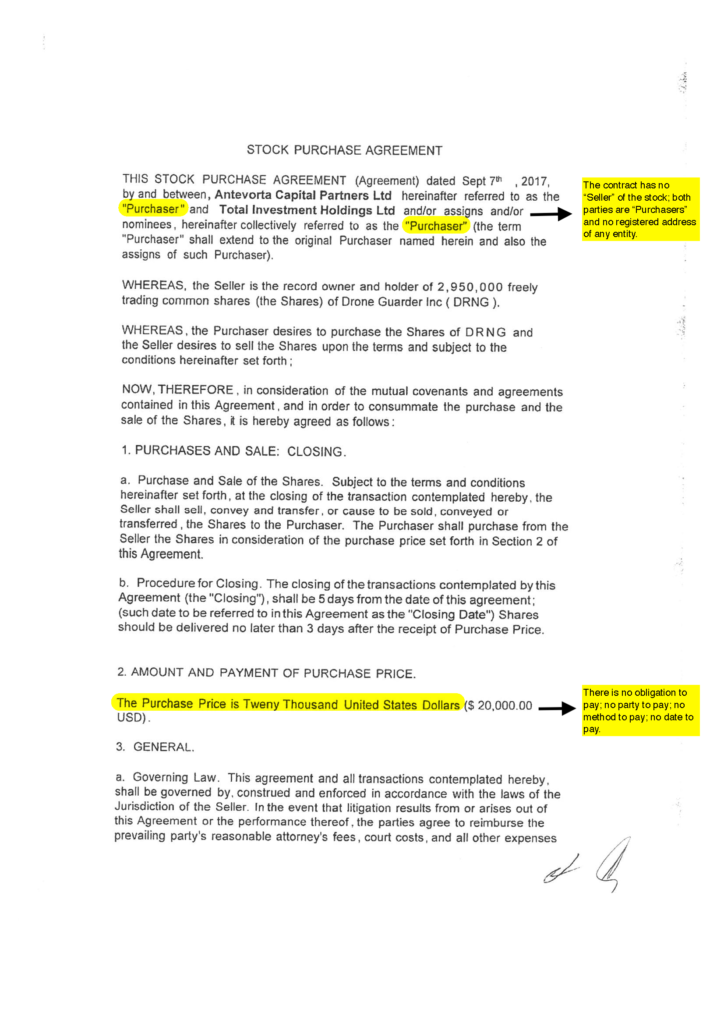

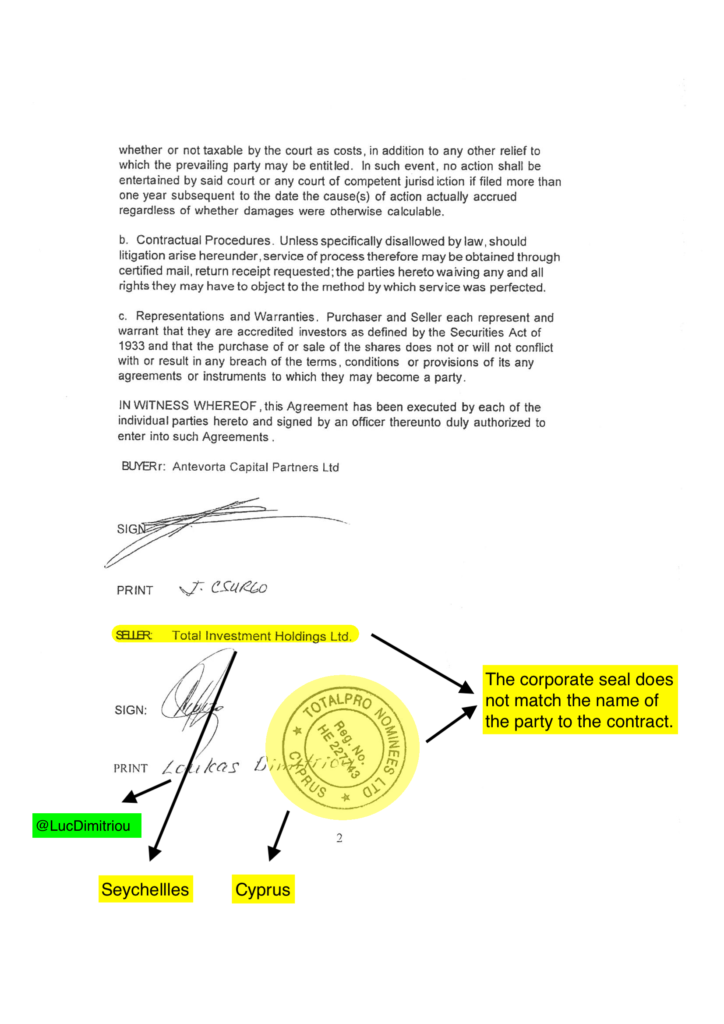

The SEC alleges that some of the defendants prepared fake stock purchase agreements purporting to evidence the purchase by Antevorta of the stock of one or more of the issuers for alleged consideration. One such agreement was with a company named Total Investment Holdings Ltd. The two pages of that agreement, below, show, for example, that there is not even a seller of the shares identified, as well as inconsistencies in respect of the parties to the contract and the use of a corporate seal.

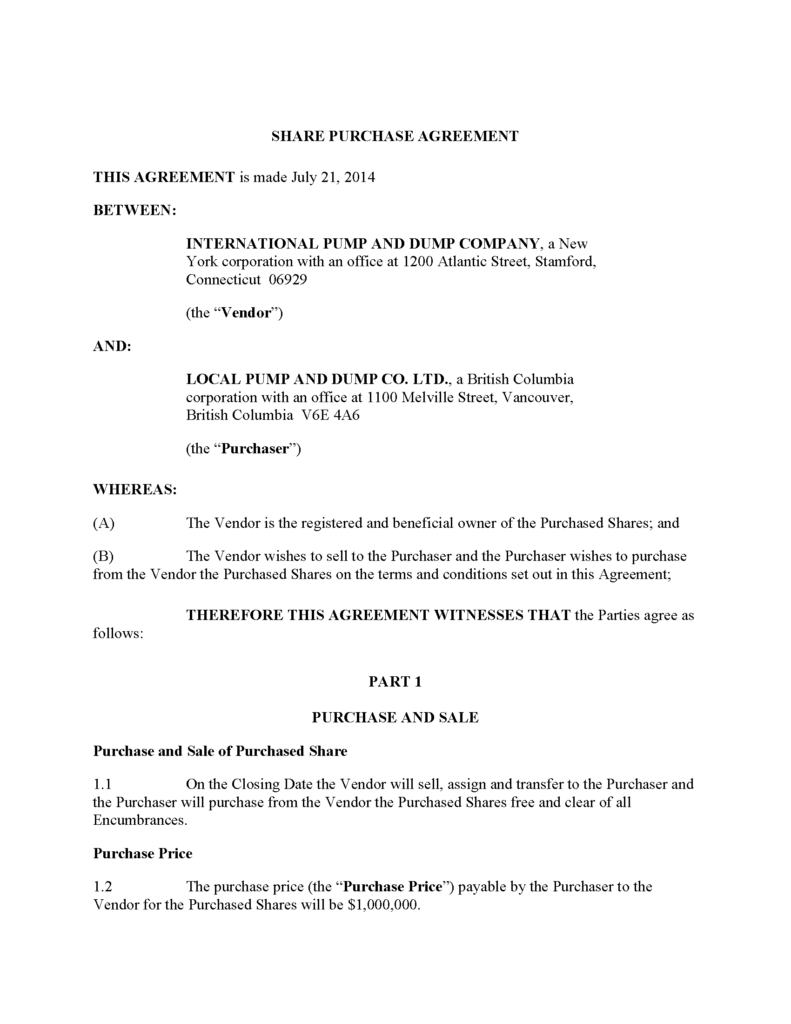

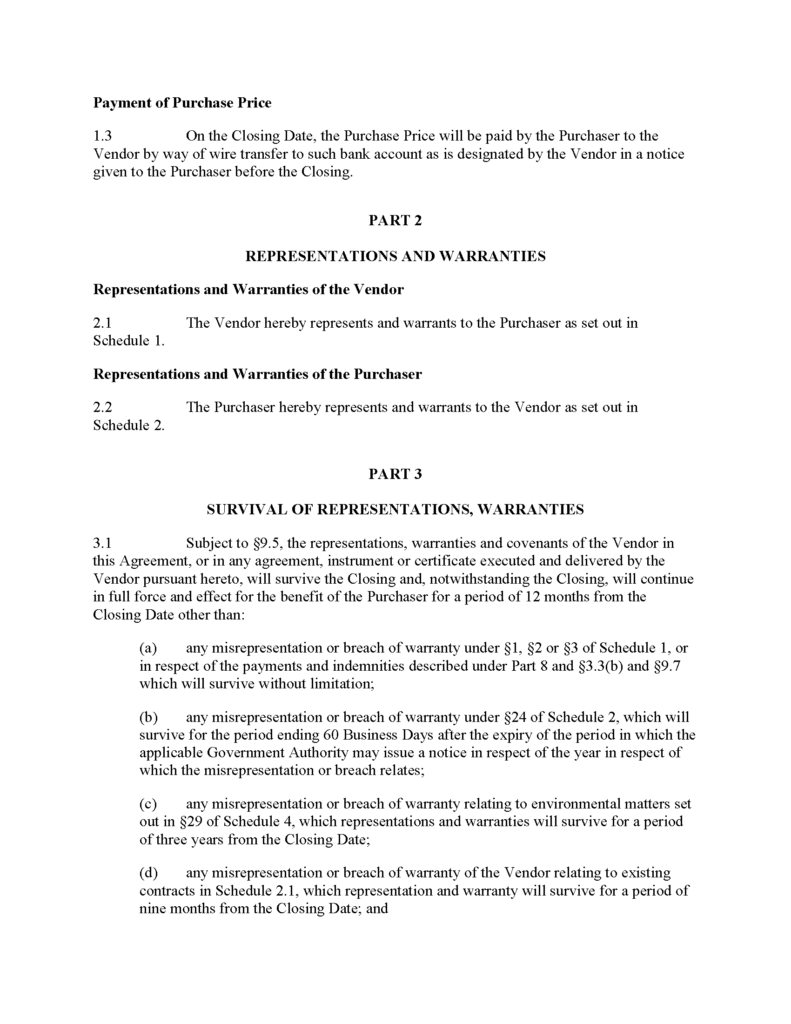

For comparison purposes, except for the fictitious party names, the two pages, below, are from a real stock purchase agreement.

Total Investment Holdings Ltd. is a shareholder of a public company in Vancouver named Green 2 Blue Energy Corp., now G2 Technologies Corp.

The SEC alleges that Csurgo also acquired Zenosense shares from Sharp, and also executed a fake stock purchase agreement purporting to evidence an alleged payment for such shares when no consideration was paid for those shares. The Csurgo alleged fake stock purchase agreement was allegedly sent to broker-dealers to defeat their compliance processes.

The SEC alleges that the Zerosense stock was pumped with Shah, Clarke and Csurgo selling over 6.3 million shares and earning proceeds of US$7.9 million. According to the SEC, they conducted a third pump and dump of Zenosense, earning US$3.2 million.

The SEC alleges that the same pattern of activity took place in respect of Drone Guarder Inc., Envoy Group Corp. and EnviroTechnologies International Inc., whereby one or more defendant amassed secret control of the stock of issuers for no consideration, orchestrated promotional activity, and engaged in manipulative trading to condition the market ahead of a pump and dump, subsequent to which shares were then dumped on innocent investors and everyone in the chain was unjustly enriched thereby.

Csurgo posted a video on YouTube on how stock manipulation works.

Second Case

In the second case, the defendants are Calabrigo, Lehner, Sario and Vasseur and they face similar allegations of securities fraud.

Vasseur is a full-patch member of the Hells Angels in Vancouver. Although a member of transnational organized crime, Vasseur was allegedly able to infiltrate the capital markets and with one or more of the defendants, allegedly controlled eight public companies.

The SEC says that for a three year period, some or all of the defendants manipulated the stock of at least nine public companies, including Zenosense, Blake Therapeutics Inc., Bingo Nation Inc., Drone Guarder Inc., Horizon Minerals Corp., I-Wellness Marketing Group Inc., Oroplata Resources Inc., Preston Corp. and Vilacto Bioscience Inc. and earned US$39 million in unlawful proceeds.

The SEC alleges that they obtained the majority of the shares of these companies from Sharp associates or from the conversions of purported debt for shares, and held such shares in various nominee and shell companies which enabled them to conceal their control of the public companies. The SEC says that they were Sharp clients and part of the Sharp circle.

The SEC alleges that Vasseur helped draft promotional emails sent to investors for at least two of the companies. In one such promotional email, investors were promised returns of 15,000%.

With another company called Bingo Nation, the defendants alleged that the company supplied gambling kiosks to gaming venues in the US which would generate US$30 million per week in revenues which promised to turn a US$2,000 investment into US$26,880 for investors.

The SEC suspended trading of the shares of Bingo Nation, and the SEC says that the company’s officers lied and denied knowledge about the pumping of its stock.

The SEC says that the defendants used a boiler room to help promote the stock of issuers they controlled. Vasseur, Lehner and Sario allegedly worked with Luis Carrillo. In August 2021, he was charged criminally and civilly in connection with alleged securities fraud as part of the Sharp cases and was allegedly part of the Sharp circle.

When the stock prices were elevated, the SEC says that one of more of the defendants liquidated stock of the issuers.

In order to move the proceeds around without running into questions by anti-money laundering professionals, the SEC says that the defendants used fake invoices and fake consulting agreements to wire funds.[2]

In these cases collectively, the SEC alleges that the defendants are responsible for pulling off a US$194 million securities fraud scheme.

There may be more cases coming down the pipe against Vancouver capital markets actors tied to the Sharp circle. But this set of cases, in particular, is important because of the threat posed to the capital markets arising from the fact that transnational organized crime allegedly infiltrated the capital markets through Vancouver and were able to allegedly control, with others, eight public companies.

In terms of liability for gate-keepers such as attorneys, providing services for criminality to enter the capital markets, the YBM Magnex case in Canada reminds us that the costs can be high – in that case, the insurers of auditors, brokers, book-runners, underwriters and lawyers had to pay $185 million to investors for facilitating Russian organized crime figures to raise money and launder it using the capital markets of Canada. Almost everyone has ignored the YBM Magnex case for over two decades but have recently come to pay it more heed as a result of new interest in the provenance of dirty money held by Russian oligarchs.

[1] Layering is a money laundering term and it involves obscuring criminal origin and as far as possible, to distance money or securities and the beneficial owners from their sources and to make it difficult for an investigator to trace the securities or funds back to that source. Layering may be done in part through repeated transfers in different locations and may involve the use of a variety of transactions and the use of corporate structures as cover.

[2] This is called trade-based money laundering, whereby fake documentation including invoices, or documentation that changes the amount or value of goods, services or securities, is created to launder money and often to defraud customs agencies. Although infrequently explored, TBML can be a material component of cross-border securities fraud and is prevalent in Vancouver, Canada.