New SEC charges

A Vancouver doctor who allegedly partnered with Vancouver lawyer Frederick Sharp in an International microcap fraud scheme (summarized here) – Avtar Singh Dhillon – was charged by the Securities and Exchange Commission (“SEC“) again today. This time it involves a different public company and hits closer to home for Vancouver residents because the company is Emerald Health Pharmaceuticals Inc. (“Emerald Pharma“).

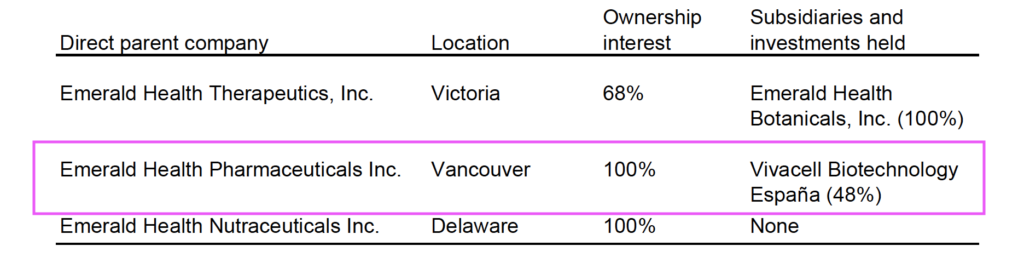

Emerald Pharma is owned 53% by Vancouver-based Emerald Health Sciences Inc., according to Deloitte LLP’s Vancouver office, which completed consolidated financial statements of Emerald Health Sciences Inc. which included the financials of Emerald Pharma.

Emerald Pharma was incorporated in Delaware in 2017, but according to Deloitte LLP, before that it was a British Columbia company located and operating in Vancouver since May 2015, and was wholly-owned by Vancouver’s Emerald Health Sciences Inc.

Emerald Health Sciences Inc. is a controversial entity because it is the control person (in the US securities common law sense) of a number of public companies but was co-founded by a US felon who was involved in one of the largest heroin smuggling cases in US history. This was not disclosed to investors at the time, but was revealed years later in an affidavit Dhillon voluntarily filed in a Court proceeding, together with a list of all of the shareholders with their addresses of the Sciences entity (which included nominees that the SEC says are, or were, controlled by Frederick Sharp). The Ontario Securities Commission held, in the Russian gangster case involving the FBI’s most wanted, Simeon Mogilevich, that criminality must be disclosed to investors, as a matter of risk. How they found a solicitor willing to do securities work with a felon co-founder is a mystery.

The SEC also charged Emerald Pharma and its CEO James DeMesa (“DeMesa“).

Undisclosed stock promotions

The SEC alleges that Avtar Singh Dhillon (“Dhillon“) and DeMesa hired a newsletter writer to write purported independent articles to promote the stock of Emerald Pharma without disclosing that the articles were paid promotional content and without disclosing who received the payment (a §17(b) issue).

According to the SEC, several executives from Emerald Pharma (whom they do not name), attended a meeting in November 2019, to work on the promotional plan, subsequent to which the SEC alleges that Dhillon arranged to secretly pay the promoter to promote a Reg A offering to US investors.

The SEC alleges that Emerald Pharma entered into fake consulting agreements as a method to move money to pay the promoter secretly.

Fake consulting agreements

Vancouver capital markets has the dubious distinction of having invented the idea of fake consulting agreements to move money, which on its face is a form of trade-based money laundering (“TBML“). TBML revolves around invoice fraud for goods or services whereby goods or services are over or under-priced, or there are invoices for no goods or services. TBML can be domestic or across state or national lines. The SEC says that in this case, fake invoices were submitted to Emerald Pharma for payment with work described on the invoices as “developing agave syrup.”

The SEC alleges that it was Dhillon who urged DeMesa to enter into the fake consulting agreements on behalf of Emerald Pharma.

The SEC also alleges, without using these words, that the promoter was being paid as a finder, earning 6% of funds raised. Emerald Pharma paid the promoter US$1.7 million to promote, plus issued shares to the promoter with a value of US$600,000. Emerald Pharma raised USS$30 million from the alleged illegal promotions.

The SEC charged Emerald Pharma, Dhillon and DeMesa with numerous securities violations for their deception, allegedly employing various schemes to defraud investors, and making materially false statements in the disclosure material of Emerald Pharma.

The SEC sought injunctive relief against Emerald Pharma, Dhillon and DeMesa, and their attorneys among others, to prevent them from continuing to break the law. Why attorneys? Because attorneys are capital markets gate-keepers – they draft the continuous disclosure, and then publish the disclosure they write on Edgar or Sedar, which investors rely upon.

Parties settled

All of the parties charged settled.

Emerald Pharma agreed to pay a penalty – more like a parking ticket really, since they raised US$30 million – of US$517,955; DeMesa agreed to pay a penalty of US$103,591.

And Dhillon?

Although there are other securities fraud charges against him, including criminal charges in connection with other public companies, he got off Scot-Free. Not even $1 did he have to pay.

It’s hard to understand the logic, or the deterrent and denunciation message of a settlement with Dhillon on such terms. He was the director, e.g., the directing mind of the entity; the person living in the luxury mansion with the greatest capacity to pay (investors on the East coast told us that Dhillon flew around on a private jet with a body guard), who may prove to be a recidivist if the Frederick Sharp related charges are concluded with a conviction.

In a shareholder newsletter of the control person, Emerald Health Sciences Inc., DeMesa once said that his philosophy is to get outstanding business results by working closely as a team and by following the philosophy of Dhillon, which he said was to ” be a family and not just a typical business.”

But alas, they were no family – they booted DeMesa out of Emerald Pharma.

Hey, Be Happy!

DeMesa runs a YouTube channel on “being happy” with 5 subscribers.