New charges levied against Dhillon and against his lawyer

Three times a charm or a curse?

A Vancouver doctor who allegedly partnered with the now-infamous Vancouver lawyer Frederick Sharp in an international microcap alleged fraud scheme (summarized here) – Avtar Singh Dhillon – was charged criminally by the US Government, the FBI announced yesterday. It’s the third set of securities-related charges against Avtar Singh Dhillon in thirteen months.

Less than a week ago, Avtar Singh Dhillon (“Dhillon“) was charged by the Securities and Exchange Commission (“SEC“) for alleged fraud in connection with undisclosed promotional activities to sell the stock of Emerald Health Pharma Inc. (those charges are summarized here).

Yesterday, the FBI announced that Dhillon was charged with conspiracy in connection with payments to the same stock promotor of Emerald Health Pharma Inc. (“Emerald Pharma“).

In connection with another microcap company, Arch Therapeutics Inc., the FBI announced that Dhillon was charged with failing to disclose stock sales and with aiding and abetting the sale of unregistered securities.

Dhillon’s lawyer charged

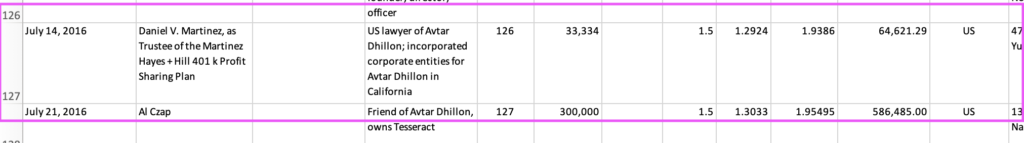

Dhillon’s lawyer, Daniel V. Martinez, was charged with the sale of unregistered securities.

The FBI alleged that Martinez created a company for Dhillon and shares of Arch Therapeutics Inc. were parked there (meaning the lawyer created the central securities register and entered Arch Therapeutics Inc. as the shareholder of that private entity the lawyer incorporated in California). The private entity then sold the shares of the public company. Because it was a private company selling and fronted by the law firm, it looked to the outside world like it was not Dhillon beneficially controlling the shares. Dhillon earned US$1.3 million in proceeds of that crime. The securities disclosure of that issuer did not disclose these events to investors or to the capital markets.

Dhillon facing 30 years in jail

Both agreed to plead guilty. Dhillon is facing a term of incarceration of up to 30 years. No date has been set for Dhillon’s sentencing. He will be sentenced pursuant to US federal sentencing guidelines in effect as at the date of the events.

Because he was heavily lawyered-up in Vancouver throughout the whole of his capital markets career, including partnering during that career with a Vancouver securities lawyer, there isn’t much he can advance downwards for the sentencing guidelines. The 30 years is a baseline – it can be increased, for example, if a person directed the intimidation of a whistleblower, attempted to obstruct justice or refused to accept responsibility. There is usually a “role enhancement”, that increases sentencing where the person was in charge. Sentencing can also be reduced (called downward departures) if, for example, a person was young and made a mistake. A defendant who enters a guilty plea is not automatically entitled to an adjustment for acceptance of responsibility because it can be outweighed by conduct that is inconsistent with acceptance of responsibility such as a defendant telling family members or business partners that he’s going to get off. The SEC, in the Frederick Sharp case, alleges that several instances of the obstruction of justice emanated from Dhillon, including in connection with a purported land transfer.

Emerald Pharma and Sciences

According to the Vancouver office of Deloitte LLP, and the last available consolidated financial statements they created of Emerald Health Sciences Inc., Emerald Pharma is owned 53% by Vancouver-based Emerald Health Sciences Inc., and it used to be a British Columbia entity that moved jurisdiction to Delaware.

In the charges announced last week, the SEC alleged that Dhillon caused officers of Emerald Pharma, whom he directed as a director, to draft fake consulting agreements to obfuscate payments to undisclosed stock promoters, and Emerald Pharma then paid fake invoices rendered by the promoters. Dhillon settled that case with the SEC and didn’t have to pay a fine for the alleged wrongful conduct. It is possible that he avoided civil penalties because of the then-undisclosed criminal charges announced today against him related to Emerald Pharma.

Dhillon voluntarily disclosed the list of shareholders of Emerald Health Sciences Inc. in a Court proceeding, and in that list Martinez appears as a shareholder.

Dhillon was dealing with the death of his father-in-law the last few weeks, and it is likely that the FBI, US Department of Justice and SEC delayed making an announcement in respect of Emerald Pharma to allow him to deal with family matters.

Adding internal controls

Emerald Pharma issued a news release two days ago (here) in which they stated that they intend to “add internal accounting controls.”

Wait – they’re going to “add” internal controls? Why were there no internal controls before?

Since Deloitte LLP completes (perhaps “completed” if they have resigned from Pharma and Sciences), the financials of both entities consolidated together, it begs two questions – how it was able to issue audited financials without internal accounting controls in place for a public company, and whether Deloitte LLP informed Emerald Health Sciences Inc. (as control person and pursuant to consolidated financials that included Emerald Pharma), that there was a significant deficiency in internal controls. An auditor is required to report on internal controls to the client and more importantly, to the capital markets.

If they didn’t, that’s an issue for Deloitte LLP; if they did, that’s an issue for Emerald Pharma.

Controversial entity

As noted here, Emerald Health Sciences Inc. is a controversial entity because Dhillon swore in an affidavit years after soliciting investments from investors, that one of its co-founders is Yadvinder Singh Dhillon. Singh-Dhillon is a US felon who was convicted of smuggling one of the largest amounts of heroin into the US with Ranjit Cheema, the deceased leader of an Indo-Canadian organized crime group. The Emerald Health Sciences Inc. entity controlled a number of public companies. One of those companies entered the legalized cannabis space in Canada and obtained a federal cannabis producer licence with the US felon in the mix.

How any of that was possible remains a mystery. Singh-Dhillon’s criminal history was well-known because the heroin smuggling case was heavily covered in the media for over a decade in Canada.

Dhillon incorporated a company in California through Martinez that they decided to name “Walk on Water” – an expression that means a person believes he or she is untouchable, superhuman, godlike. One suspects the FBI may have some views on that.